🗣 SL提问: Cashflow

✍️ Ai批改: A crucial topic in finance! Cash flow refers to the movement of money into or out of a business, organization, or individual's accounts over a specific period of time、It's a vital concept in accounting and finance, as it helps assess a company's or individual's liquidity, solvency, and financial health.

Types of Cash Flows:

1、Operating Cash Flow: Cash inflows and outflows related to a company's core business operations, such as sales, purchases, and expenses.

2、Investing Cash Flow: Cash inflows and outflows related to investments, such as buying or selling assets, investments in other companies, or acquiring new businesses.

3、Financing Cash Flow: Cash inflows and outflows related to financing activities, such as borrowing or repaying loans, issuing or repurchasing shares, or paying dividends.

Cash Flow Statement:

A cash flow statement is a financial statement that summarizes a company's inflows and outflows of cash over a specific period, usually a month, quarter, or year、It provides insights into a company's:

1、Cash receipts: Cash received from customers, loans, or investments.

2、Cash payments: Cash paid to suppliers, employees, lenders, or for expenses.

3、Net change in cash: The difference between cash receipts and cash payments, which represents the change in a company's cash balance.

Why Cash Flow is Important:

1、Liquidity: Cash flow helps assess a company's ability to meet its short-term obligations, such as paying bills and salaries.

2、Solvency: Cash flow indicates a company's ability to service its debt and maintain its financial stability.

3、Investment and growth: A positive cash flow can indicate a company's ability to invest in new opportunities, pay dividends, or repay debt.

Common Cash Flow Ratios:

1、Operating Cash Flow Margin: Operating cash flow divided by sales revenue, which indicates a company's ability to generate cash from its core operations.

2、Cash Flow Return on Investment (CFROI): Net operating cash flow divided by total capital employed, which measures a company's return on investment.

3、Debt-to-Cash Flow Ratio: Total debt divided by operating cash flow, which assesses a company's ability to repay its debt.

Cash Flow Management:

Effective cash flow management involves:

1、Cash flow forecasting: Estimating future cash inflows and outflows to anticipate potential cash shortfalls or surpluses.

2、Cash flow monitoring: Regularly reviewing cash flow statements to identify trends and areas for improvement.

3、Cash flow optimization: Implementing strategies to improve cash flow, such as reducing accounts receivable or payable, or negotiating better payment terms.

By understanding and managing cash flow effectively, individuals and businesses can make informed decisions about investments, financing, and growth strategies、Do you have any specific questions about cash flow or would you like me to elaborate on any of these points?

0

IP地址: 92.27.118.252

搜索次数: 67

提问时间: 2025-04-11 11:09:09

❓️ 热门提问:

外汇系统源码

ai会议记录免费

外汇开户门槛

外汇黄金交易策略

长毛金渐层25色一般在什么价位

上海黄金交易所板料

ai数字人主播

1克黄金多少钱今天

详细介绍域名www.mm.tj.cn的含义、价值与适合的行业。

北京老铺黄金文化发展有限公司

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

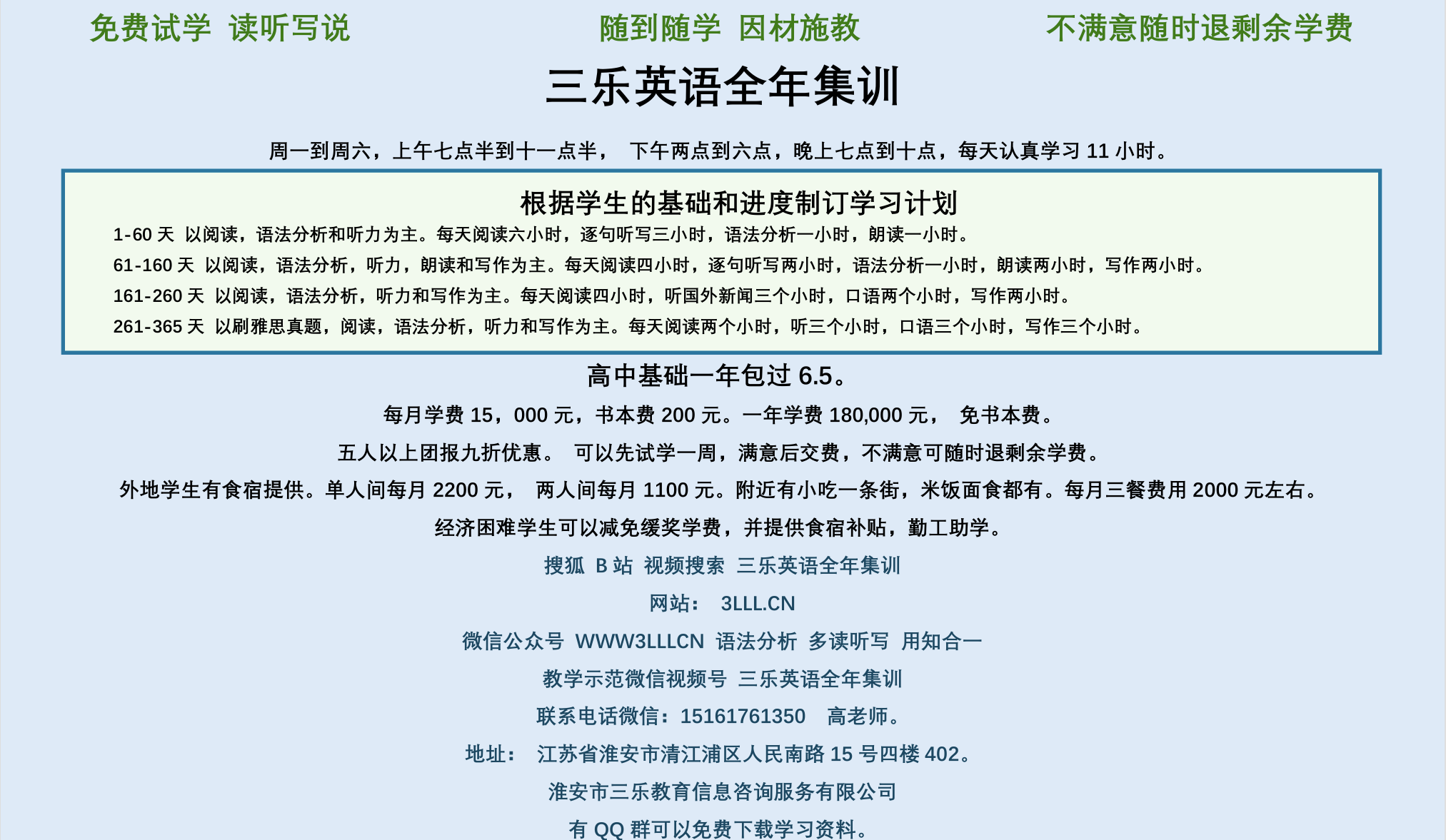

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。